Contact Us

Please complete the form below so that we can email you with your local Z-SYSTEMS Doctor information within 48 hours.

Are you a clinician interested in integrating ceramic dental implants into your practice?

Learn More

Simply put, dental implants cost so much because a dental implant isn't just any one thing. It's a surgery, dental procedure, X-ray and potential tooth extraction and bone graft all in one, and all of these complicated procedures quickly add up. Furthermore, the materials alone can run thousands of dollars. Add to that the fact that everyone's mouth and teeth are different, with unique challenges, approaches, and solutions, so each aspect of your dental implant is truly a custom job that, quite frankly, shouldn't include any cutting of corners, especially as you'll have to live with your implants for years to come.

Sure, you can shop around for a dentist that may perform your procedure at a reduced rate, but you're likely getting sub-par materials and service for it -- and would you ever consider running that same risk with your doctor? Odds are you want the best dentist in your area to improve or maintain one of the most crucial aspects of your look -- your smile. Go with a cheap dentist and you could do irreparable damage to your teeth, or even risk other health complications. When it comes to your teeth, it pays to get the best you can. After all, your smile is an important part of who you are, so don't skimp out.

With a cost between $1,000 and $3,000 per tooth, dental implants are not cheap. Add to that a crown and abutment that can run anywhere from $500 to $3,000, and you're looking at a total of around $1,500 to $6,000 on average. However, that's the out-of-pocket, one-time price, and dental insurance and other payment plans can help you reduce the total to a more manageable monthly fee that you can stretch out over a few years. In certain situations, a single implant may run you a little less or more depending on your specific circumstances, but only a dental consultation will be able to tell you the true cost of your implant.

If you need multiple ceramic implants, be prepared to pay more than the cost of one implant. That said, your costs may not scale with each missing tooth since bridges and other cost-saving measures can give you three or four ceramic teeth that are anchored by just two implants. Even so, these types of implants require a healthy gum line to securely hold each implant, and any bone grafts or other required surgery can further increase the cost of the entire procedure.

If a bridge or several implants won't do the trick, you may need a full-mouth implant, which is also known as implant-supported dentures. While full-mouth dental implants may cost you as much as a new car, you can treat them like your real teeth, with no need to mess with sticky glues and adhesives, and you won't have to remove them at night to be cleaned. Due to tricky gum line fitment, many elect for a bottom denture while treating their top teeth with individual implants as needed.

Further increasing the cost of many dental implants, it's often the case where your dentist must extract existing teeth before they can install your implant. While the cost of extraction depends heavily on your particular teeth and how long and difficult it is to complete the extraction, an extraction can easily cost several hundred dollars, which can multiply if you need more than one extraction, or if your extraction is particularly difficult.

In addition to the above, you'll also need to pay for an anesthesiologist on the day of your implant, X-rays or CT scans to determine the best approach for your dental implants, and possibly a bone graft to provide a secure foundation for your implant. Each of these can run hundreds of dollars or more, and each complication further raises your total cost.

Just like your car mechanic that charges you separately for parts and labor, your dentist also has very real costs associated with installing an implant. For starters, the implant itself, which is typically zirconium (ceramic) or titanium, can cost up to $2,000. Additionally, the abutment, which attaches the crown (or tooth) to the implant, can cost up to $500 -- and the crown itself can run anywhere between $1,000 and $3,000. In total, this could run up to $5,000 just in material costs, making the labor side of the equation comparatively cheap.

If you've been putting off a dental implant because you're worried about the costs, we may be able to help. From affordable payment plans and our easy-to-use find a dentist directory, you can have healthy ceramic dental implants that will last a lifetime for a low monthly cost that you can afford today. What are you waiting for? Contact us now to see how we can turn your dental problems into a beautiful new smile with ceramic dental implants, and you'll never again have to worry about how much ceramic dental implants cost.

Pays

$150/mo

For 48 Months

Pays

$175/mo

For 36 Months

Pays

$200/mo

For 24 Months

Are you not interested in a payment plan for dental implants thru a financing company? There are other creative ways to help cover the cost of dental implant procedures. Below are five alternate options to help cover the cost of implant surgery. See if one of the options below is a great fit for you.

A flexible savings account, or FSA, is a like a personal savings account that can be used to pay for certain medical and dental procedures including dental implants. Your FSA is offered through your employer, and you pay money into the account throughout the year, usually through a deduction from your paycheck. You may set aside up to $2,600 annually. Not all employers offer an FSA.

A health savings account, or HSA, is a special savings account that only employees with a high-deductible health insurance plan are eligible for. You put money into the account and can use it to cover certain medical and dental procedures including dental implants. You may set aside up to $3,400 for an individual or $6,750 for a family annually. You must meet several IRS requirements in order to be eligible to open an HAS. Click here to see what those IRS eligibility requirements are.

The advantage of an FSA or HSA is that you don’t pay taxes on the money you put in an FSA or HSA because the funds are deposited into the account on a pre-tax basis.

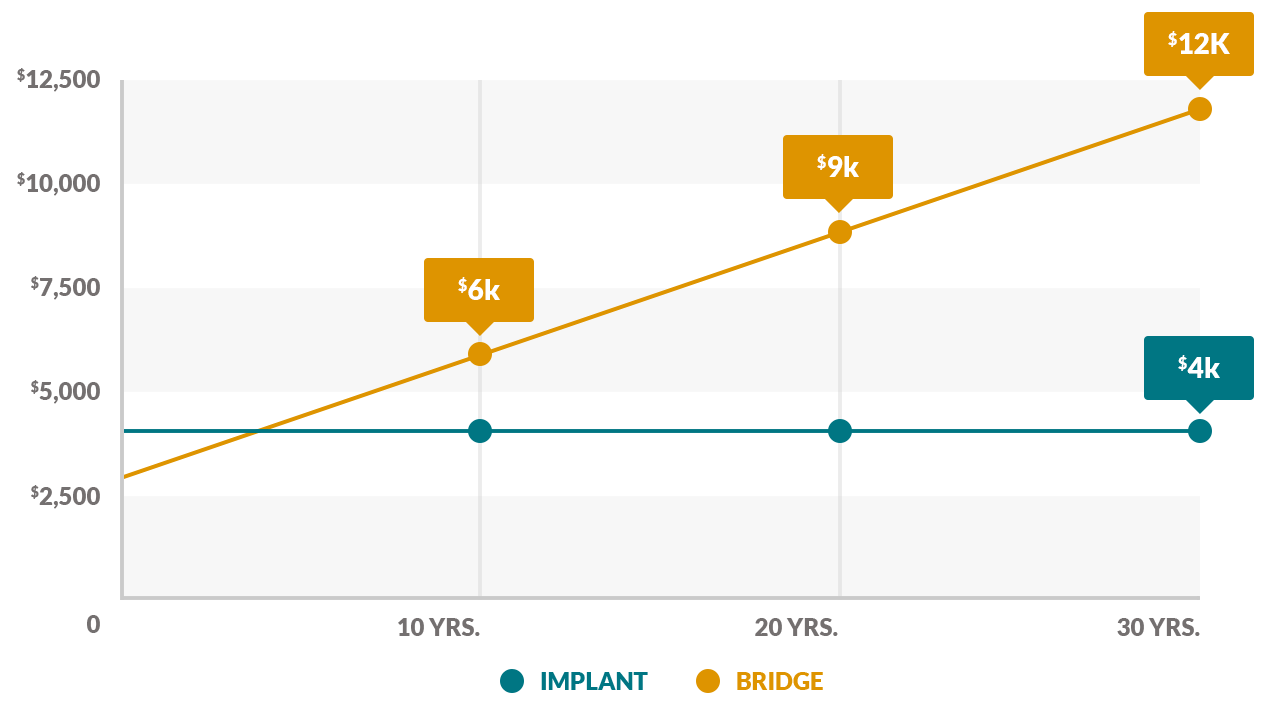

The cost of any dental procedure will vary based on your location, materials used and your specific dental needs. No matter the price, one thing is very clear: the lifetime cost of a dental implant is almost always drastically less than a dental bridge.

The average cost of a 3-unit dental bridge is around $3,300 and lasts 7-10 years before needing to be replaced. Compare that to a dental implant, which is slightly more initially at $4,263 on average, but can last a lifetime.[14]

Over the next 30 years, a bridge may need to be replaced 3 or more times. Choosing a traditional 3-unit bridge over a dental implant could cost you three times as much as a dental implant. Investing slightly more for a dental implant up-front could save you thousands of dollars in the long run.[14]

Thousands of people choose dental implants to replace their missing teeth every month. But, how satisfied are they with their implants after their procedures? According to a survey, implant patients were satisfied with their dental implant 99% of the time, which is incredible! 97% of implant patients would recommend an implant procedure to a friend with missing teeth. 96% of implant patients say their ability to chew different foods improved drastically and 98% of implant patients loved the appearance of their smile after implant surgery. You will love your new smile with natural-looking ceramic implants. See patient satisfaction ratings from real patients with dental implants to replace a front tooth.[15]

99%

Overall satisfaction with implant

97%

Would recommend to a friend

98%

Appearance of implant when smiling

96%

Ability to chew different foods

Contact us and we will send you contact information for a provider in your area within 48 hours.