I think at this point, it's pretty widely accepted that dental implants are the best option to replace missing teeth.

The concern isn't over choosing the best option anymore - it's affording the obvious one.

If you're considering draining your daughter's wedding fund and hoping she becomes a nun, just hold on a second. If we put the right pieces together, I'm confident that even you can afford dental implants (without doing anything crazy.)

Now we're going to exploit where we are in our calendar year on this one, so keep in mind that it's time sensitive - let's look at how to maximize your dental insurance.

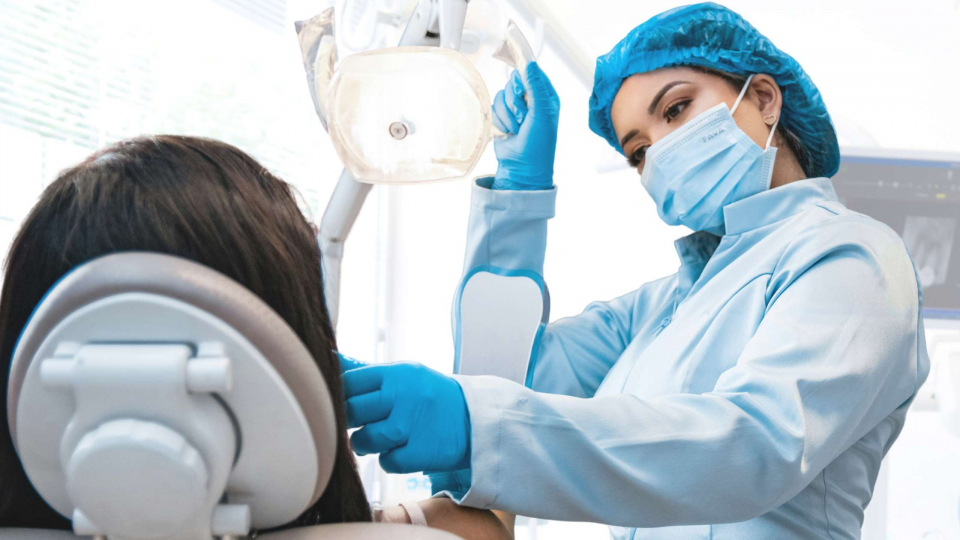

Will dental insurance cover dental implants?

This is maybe the question we get asked most. After all, you pay into your dental insurance month after month -can they help us out here?

The answer is - sometimes.

Coverage can be a little tricky. Here's what to do first.

Ask for a 'predetermination of benefits'

Read your plan documents first. Do that. But I don't care how many times you scour them, it'll still be hard to know what your insurance company will ACTUALLY cover until they just tell you.

Ask your provider to send a "pre-determination of benefits" to your insurance company before your treatment. Your insurance company will process the estimate as if it were an actual claim for services and send you a statement of what they WOULD have paid for if this was an actual claim.

This is the best way to get the most straightforward information from them.

Maximize the timeline

Plan your treatment to maximize your insurance plan's contribution. Most plans have an annual maximum amount that they'll pay out for dental treatment (usually around $1500 or so).

Most dental implant procedures happen in 2 phases. During the first phase, your implants are placed and temporary teeth are put on top of them. A healing period of around 3 months then begins, when your implants are undergoing osseointegration (binding to your bone). Then you move to your second phase where your implants are uncovered and your final crowns are placed.

My advice? Schedule phase 1 for the end of the year and phase 2 for the beginning of the next. That way you'll have a brand new maximum when the year starts.

Dental implants not covered? Use your HSA or Medical Flex Account

Even it looks like your dental insurance isn't going to cover the cost of your implant procedure, you can STILL use your HSA or Medical Flex Account to cover the cost. And that money's pre-tax so it'll cover even more than you think!

Just remember that those funds don't roll over. You have to use them before the end of the year or you lose them.

Implants STILL not covered? The crown probably IS!

Even if dental implants are excluded completely under your plan, if the plan covers a traditional dental crown, they have to cover a dental implant crown.

This means you'll be entitled to at least partial coverage.

Now go get started! The year is almost out so let your insurance company know you need some answers and fast.

Then start planning your New Year's Eve party because you're gonna want to show off those new teeth!